Big Beer Makes a Big Move

Each year, General Distribution's Jim Fick closely tracks the sales of Oregon beer in Oregon, and he very graciously forwards me the spreadsheet with the numbers. Frustratingly, the OLCC, which tracks these numbers, has gotten fairly lax and the figures aren't terribly reliable. One obvious example is that they somehow don't capture CBA's sales (Widmer/Redhook/Kona)--one of the two largest breweries in the state. Some of their other numbers are suspect as well. Given these troubles, I figured 2015 would be the last year I commented on these, but there are a couple things that leap out so profoundly I can't help but comment on them. Actually, commenting may not even be necessary--just look at these two graphs.

and

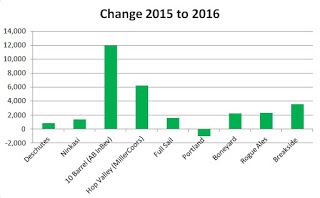

To put precise numbers to these--excluding GoodLife, for which the OLCC had no numbers in 2015--the two beer companies owned by multinational corporations grew 18,161 barrels in 2016, and the other top ten breweries grew 10,851. Combined. And even that sort of understates matters. Have a look at the top gainers in 2016:

ABI and MillerCoors account for 40% of all gains among the ten breweries growing the fastest. There is probably a lot of context one could provide to explain why these two brands grew so much (discounting, distribution, etc), but the fact is they did. Oregon has one of the most parochial markets in the country, and they still posted these remarkable increases. Two of the top five best-selling brands in the state are owned by companies in Wisconsin Chicago and Leuven, Belgium.

Things change. Who knows if this is a stable trend and whether 10 Barrel and Hop Valley will continue to grow--or even keep their share (look what happened to BridgePort). But for the moment they're selling like hotcakes, and I doubt there's a brewer in the state who's not unsettled by this development.