Devils Backbone (VA) to AB InBev

Update/Upon Further Consideration (10:48 am)

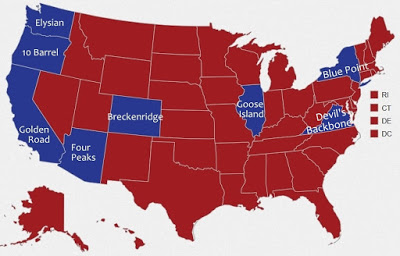

The one category of interest that these acquisitions bring to mind has to do with strategy, future acquisitions, and timelines. How many breweries does ABI need to complete their "High End" portfolio? What do they plan to do with these beers? How will the US strategy unfold as ABI pairs the High End brands with the flagship mass market lagers? All interesting stuff. We have begun to suspect that ABI is looking to knit together a portfolio of regional breweries, so looking at the map might suggest where they're headed next. We know that they tend not to purchase very large breweries--50,000 to 100,000 seems to be the range.

Another piece I'd add to the calculation is flagship brands. Devil's Backbone is known for lagers and their flagship is the Vienna Lager. They've been buying a lot of breweries that are known for IPAs, and that causes a logjam stylistically; Devil's Backbone doesn't compete with them. I'd bet this is more than a passing consideration for ABI moving forward.

This is getting to be a boring novel in which all the chapters repeat. There's nothing to say that hasn't been said in the earlier chapters (see: 10 Barrel, Breckenridge, Four Peaks, Elysian), but if you want details, go here for the press release. Funari reports that they brewed95,000 62,000 barrels last year [with projections for 95k in 2016], which puts them in that ABI sweet spot.

But the news does give me the opportunity to post my updated map of ABI holdings. So there's that.

The one category of interest that these acquisitions bring to mind has to do with strategy, future acquisitions, and timelines. How many breweries does ABI need to complete their "High End" portfolio? What do they plan to do with these beers? How will the US strategy unfold as ABI pairs the High End brands with the flagship mass market lagers? All interesting stuff. We have begun to suspect that ABI is looking to knit together a portfolio of regional breweries, so looking at the map might suggest where they're headed next. We know that they tend not to purchase very large breweries--50,000 to 100,000 seems to be the range.

Another piece I'd add to the calculation is flagship brands. Devil's Backbone is known for lagers and their flagship is the Vienna Lager. They've been buying a lot of breweries that are known for IPAs, and that causes a logjam stylistically; Devil's Backbone doesn't compete with them. I'd bet this is more than a passing consideration for ABI moving forward.

________________

This is getting to be a boring novel in which all the chapters repeat. There's nothing to say that hasn't been said in the earlier chapters (see: 10 Barrel, Breckenridge, Four Peaks, Elysian), but if you want details, go here for the press release. Funari reports that they brewed

But the news does give me the opportunity to post my updated map of ABI holdings. So there's that.